IL IL-2848 2009 free printable template

Show details

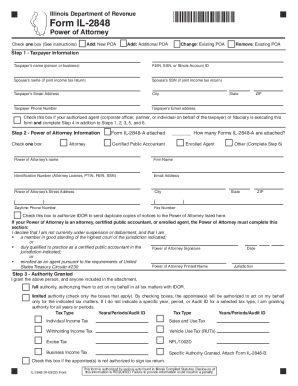

Illinois Department of Revenue IL-2848 Power of Attorney Read this information first Attach a copy of this form to each specific tax return or item of correspondence for which you are requesting power of attorney. Signature of witness appeared this day before a notary public and acknowledged Signature of notary Notary seal IL-2848 back R-12/14 This form is authorized as outlined under the Illinois Income Tax Act. File a protest to a proposed asse...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your il 2848 2009 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your il 2848 2009 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing il 2848 2009 form online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit il 2848 2009 form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

IL IL-2848 Form Versions

Version

Form Popularity

Fillable & printabley

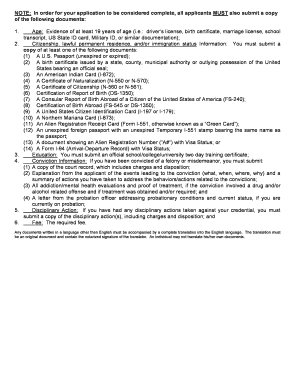

How to fill out il 2848 2009 form

How to fill out IL 2848 2009 form:

01

Obtain a copy of the IL 2848 2009 form from the Illinois Department of Revenue's website or by visiting their local office.

02

Fill in your personal information accurately, including your name, address, social security number, and contact information.

03

Indicate the tax year or years for which you are authorizing representation or power of attorney.

04

Specify the type of tax or taxes for which you are authorizing representation, such as income tax, sales tax, or payroll tax.

05

Provide the name, address, and contact information of the individual or the tax firm that you are authorizing to act on your behalf.

06

Sign and date the form.

07

Attach any necessary supporting documents, such as a copy of your identification or proof of authority if you are representing a business or an organization.

08

Mail or deliver the completed form and any attachments to the appropriate address provided on the IL 2848 2009 form.

Who needs the IL 2848 2009 form:

01

Individuals or businesses who want to authorize someone else to represent them or act as their power of attorney regarding Illinois state taxes.

02

Taxpayers who are unable or prefer not to handle their own tax matters and require assistance from a trusted representative.

03

Individuals or businesses facing complex tax issues or audits that may require professional representation.

Note: It is recommended to consult with a tax professional or the Illinois Department of Revenue for specific guidance and instructions when filling out the IL 2848 2009 form.

Fill form : Try Risk Free

People Also Ask about il 2848 2009 form

Who needs to file form 2848?

Does a power of attorney have to be filed with the court in Illinois?

What is the tax form for power of attorney in Illinois?

What is a 2848 form in Illinois?

What is a durable power of attorney for finances in Illinois?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is il 2848 form?

Form 2848 is a tax form issued by the Internal Revenue Service (IRS) in the United States. It is also known as Power of Attorney and Declaration of Representative. The purpose of this form is to authorize an individual or a business to represent the taxpayer before the IRS and handle their tax matters. The representative is allowed to discuss the taxpayer's account, receive information, sign documents, and perform other administrative tasks on behalf of the taxpayer. The form must be completed and signed by the taxpayer and the representative in order for the representative to have the authority to act on behalf of the taxpayer.

Who is required to file il 2848 form?

The Form 2848, Power of Attorney and Declaration of Representative, is required to be filed by any taxpayer who wants to authorize someone else, such as an attorney, accountant, or enrolled agent, to represent them before the Internal Revenue Service (IRS). This form is commonly used when a taxpayer requires someone to act on their behalf in matters related to their federal tax liabilities, audits, appeals, or collection activities.

How to fill out il 2848 form?

To fill out Form IL-2848, Illinois Power of Attorney and Declaration of Representative, follow the steps below:

1. Download Form IL-2848 from the official Illinois Department of Revenue website or obtain a copy from your tax professional.

2. Begin by entering your name, address, and daytime phone number in the "Taxpayer Information" section.

3. Provide your Social Security Number (SSN) or Employer Identification Number (EIN) in the appropriate field.

4. Specify the period for which the power of attorney is granted by indicating the "Tax Year(s) or Period(s)" in the designated box.

5. Enter the name, address, and phone number of the individual you are appointing as your representative in the "Representative Information" section.

6. Check the appropriate box to indicate whether the representative is an individual or a firm.

7. If the representative is a firm, provide the firm's EIN or SSN, followed by the name and title of the authorized person representing the firm.

8. Tick the box that accurately describes the specific tax matters for which the representative is authorized to act on your behalf, such as income tax, sales tax, property tax, etc.

9. If you want to revoke a prior power of attorney, check the corresponding box and provide the date of revocation.

10. Sign and date the form in the appropriate fields. If you are a taxpayer who is a corporation, partnership, or LLC, a corporate officer, partner, or member authorized to sign should do so.

11. Submit the completed and signed Form IL-2848 to the Illinois Department of Revenue either by mail or electronically through their e-Services portal.

It is crucial to carefully review the form and ensure accuracy before submission. Additionally, consider consulting a tax professional when completing the form to ensure compliance with any specific circumstances or questions you may have.

What is the purpose of il 2848 form?

The purpose of the IL 2848 Form, also known as Power of Attorney and Declaration of Representative, is to authorize an individual or representative to act on behalf of a taxpayer before the Illinois Department of Revenue. This form allows a designated representative, such as a tax attorney or accountant, to receive and inspect confidential tax information, represent the taxpayer in tax matters, and sign agreements or documents related to the taxpayer's tax affairs in Illinois. It grants the representative the authority to perform all acts that the taxpayer is entitled to do concerning their tax matters.

What information must be reported on il 2848 form?

Form IL-2848, Power of Attorney and Declaration of Representative, is used in the state of Illinois to authorize someone to act on behalf of an individual or entity regarding tax matters. When completing this form, the following information must be reported:

1. Taxpayer information: The full legal name, address, taxpayer identification number (Social Security Number or Employer Identification Number), and daytime phone number of the taxpayer(s).

2. Representative information: The full legal name, address, and daytime phone number of the representative being authorized to act on behalf of the taxpayer(s). This can be an individual or a recognized firm or organization.

3. Tax matters: Specify the tax types and periods for which the representative is authorized to act. This may include income tax, sales tax, withholding tax, etc. Provide the tax years or periods that the authorization covers.

4. Signature and declaration: The taxpayer(s) must sign and date the form, declaring that the information provided is true, correct, and complete to the best of their knowledge.

It is essential to carefully review the instructions provided with the IL-2848 form to ensure all required information is included and the form is completed accurately.

When is the deadline to file il 2848 form in 2023?

The deadline to file Form 2848, Power of Attorney and Declaration of Representative, for the year 2023 will likely be April 18, 2023. However, it is always recommended to check the official IRS website or consult with a tax professional for any possible changes to deadlines.

What is the penalty for the late filing of il 2848 form?

The Form IL-2848 is used in Illinois for power of attorney declaration. It allows a taxpayer to authorize someone else to represent them before the Illinois Department of Revenue. There is no specific penalty mentioned for the late filing of Form IL-2848. However, it is generally recommended to file the form before the representation begins to avoid any potential issues or delays in the process. It is advisable to consult with a tax professional or contact the Illinois Department of Revenue directly for specific information on any potential penalties or consequences for late filing.

How can I edit il 2848 2009 form on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit il 2848 2009 form.

How do I fill out the il 2848 2009 form form on my smartphone?

Use the pdfFiller mobile app to complete and sign il 2848 2009 form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit il 2848 2009 form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share il 2848 2009 form from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your il 2848 2009 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.